Project Snapshot

Project Overview

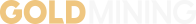

São Jorge is a resource stage gold exploration project located within the top-tier Tapajós Gold District. São Jorge is located 4 km west of the Cuiabá-Santarém Highway BR-163 and is accessed by several gravel roads that cross the property. The regional land package comprising of 7 exploration permits totals 45,997 ha (459.97 km2).

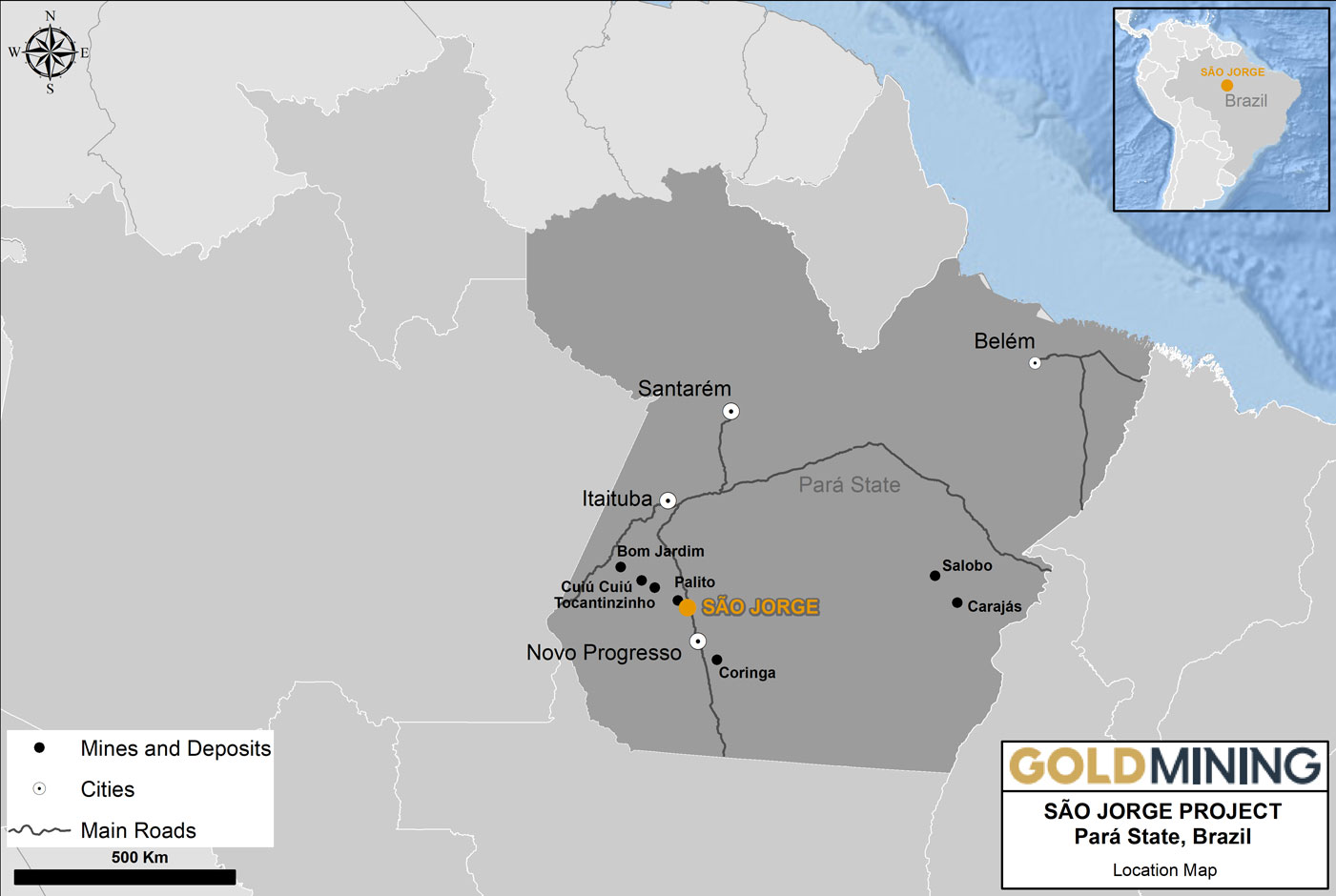

The São Jorge Project has indicated resources of 0.71 million gold ounces and inferred resources of 0.72 million gold equivalent ounces (see Resources). G-Mining Venture's feasibility-stage Tocantinzinho deposit and Serabi Gold Plcꞌs Palito mine, occur along the same major structural zone that hosts the São Jorge deposit.

Mineral resources have been estimated at the São Jorge deposit, that occurs along a shear zone that has been drill tested over a strike length of approximately 1.4 km. The São Jorge structural corridor remains open along strike to the northwest and southeast. Several additional geophysical and geochemical target anomalies within the broader mineral system remain untested.

Location

Tapajós Gold District in Pará State, Brazil

Property Size

45,997 ha (459.97 sq km)

Ownership

100%

Commodity

Gold

Infrastructure

Paved highway, camp, water, nearby electrical power grid.

Deposit Type

Orogenic gold

Location

The São Jorge Gold Project is located in the southeast of Pará State, Brazil, in the municipality of Novo Progresso. The region is known as the Tapajós Gold District and São Jorge is located 320km south of the main regional city of Itaituba. Access to the São Jorge Gold Project from the cities of Itaituba or Novo Progresso is via highway BR-163, or a 1-hour flight from Itaituba.

The Project comprises 7 exploration permits covering an aggregate area of approximately 45,997 ha (459.97 km2) in the Tapajós Gold District of Pará. The claims are 100% owned by GoldMining INC.

A camp facility exists near the deposit with all-year access by paved highway, water and nearby electrical grid.

Tapajós Gold District

The Company’s 100% owned São Jorge Project sits at the center of the active and rapidly developing Tapajos Gold District. The region is estimated to have produced over 20 million ounces gold from artisanal mining of surface deposits, according to the Brazil National Mining Agency.

The now paved Hwy BR-163 has reduced hurdles for more traditional bedrock mine development in the region, including Serabi Gold plc.’s (“Serabi”) producing high-grade underground Palito Mine and G Mining Ventures Corp.’s (“G Mining”) Tocantinzinho open pit mine development project (G Mining Ventures Corp.) which is reportedly >75% constructed as of January 15, 2024.

Hardrock gold mineralization defined to date within the Paleoproterozoic Amazon Craton comprise mainly structurally controlled hydrothermal deposits broadly regarded as being of orogenic type. However, growing evidence of copper + gold geochemical systems, associated with magmatic intrusive centers, has led explorers to target copper-gold porphyry-style mineralization.

Both G Mining and Serabi have discovered porphyry style mineralization on their exploration claims, comprising the ‘Santa Patricia Copper Anomaly’ and the ‘Matilda Copper Project’ respectively. Reprocessed geophysical data from São Jorge indicates the potential for porphyry intrusive centers on the Project, analogous to the recently reported Matilda porphyry discovery located approximately 50 km to the northwest.

Geology and Mineralization

The São Jorge property is underlain by a granitoid pluton dominantly composed of an amphibole-biotite monzogranite. The gold mineralization is hosted in a circular shaped body comprised of the younger São Jorge granite. The intrusive body measures approximately 1.2km in diameter and is generally massive, grey to pink in colour with a porphyritic granular texture.

The São Jorge intrusion is sub-parallel to the strike of the regional Cuiú-Cuiú - Tocantinzinho shear zone, which also hosts several important gold deposits including the Palito mine, Tocantinzinho and Cuiú-Cuiú deposits, and Bom Jardim and Batalha gold prospects.

Gold Mineralization:

Gold mineralization is related to a hydrothermal alteration zone in the monzogranite along a structurally controlled fracture array - vein system, approximately 1,400m long and up to 160m wide, and intersected in drill holes up to 350m below surface.

The mineralization is open along strike and down dip. The main trend is 290° with an almost vertical dip. The main mineralized zone is defined by a sharp but irregular contact between altered and unaltered monzogranite to the southwest and a more gradational transition from altered to unaltered rocks to the northeast.

Strong alteration is associated with discrete quartz veinlets (1 to 2cm wide), associated with coarse pyrite grains and clusters that cut zones of intense quartz flooding.

Activities:

- Historic drilling completed: 145 holes (37,154 m)

- Established resources include 711,800 oz gold Indicated at 0.3 g/t gold cut-off & 716,800 oz gold Inferred at 0.3 g/t gold cut-off (See resource)

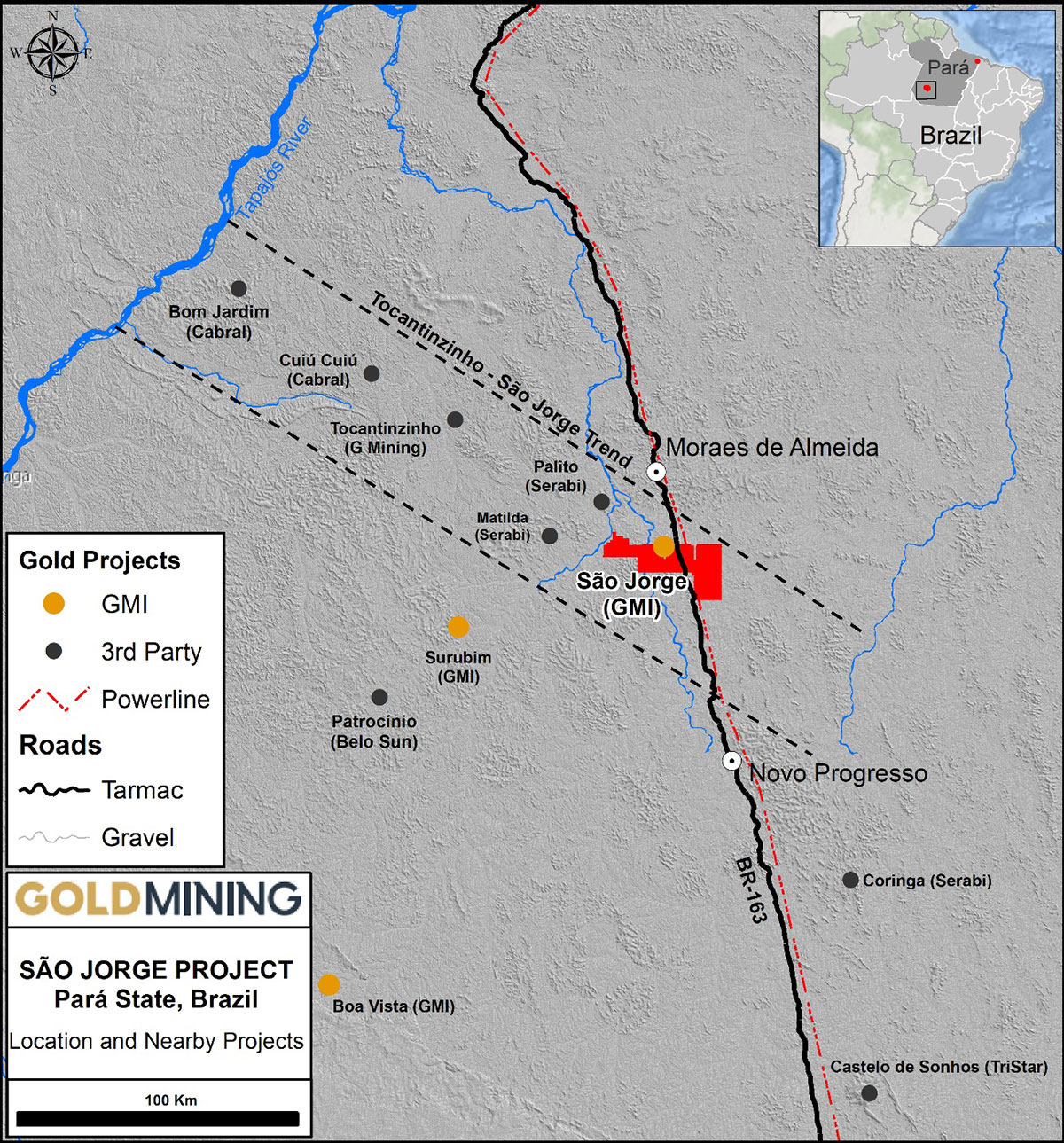

- Regional –scale stream sediment sampling has identified a broad and strong gold anomaly, and systematic grid soil sampling has outlined a large 12 km x 7 km geochemical footprint comprising elevated gold ± copper ± molybdenum surrounding the São Jorge deposit and open in all directions

- Geophysical processing supports a potential porphyry magmatic signature over parts of the São Jorge property

- Exploration efforts have produced over 9,000 soil samples and 600 rock samples

Resource Statement

Notes to Resources:

1. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

2. The Mineral Resource for the São Jorge deposit have been confined by an open pit with "reasonable prospects of eventual economic extraction" using the following assumptions:

- Gold price of US$1,600/oz Au;

- Payable metal of 99% payable Au, 90% payable Ag and 1% deduction for Cu;

- Discount rate of 10%;

- Royalty of 3% NSR;

- Pit slopes are 35 degrees for saprolite and 52 degrees for fresh rock;

- Mining cost of US$2.00/t; and

- Processing, general and administrative costs of US$10.60/t.

3. Metallurgical recoveries are 86.5% for Au

4. Numbers may not add due to rounding.

5. Based on technical report titled "São Jorge Gold Project, Pará State, Brazil, Independent Technical Report on Mineral Resources" with an effective date of May 31, 2021, which is available at http://www.sedar.com under GoldMining's SEDAR profile.

Gallery

Camp entrance, 2023.

Core storage at the camp, 2023.

Soil sampling, 2023.

Tapajós Gold Distict and the location of São Jorge.

Soil geochemical anomalies (1) William South (Au); (2) Geraldo Mineiro (Au + Cu); (3) Wellington South (Au + Cu); (4) Pedro Gaucho (Au); and (5) Eye Copper Anomaly (Cu ± Mo). The area labelled ‘A’ contains broad-spaced strong Au stream sediment anomalies indicative of potential to expand the soil geochemical footprint westward.